Tips to optimize your 2022 CPG ecommerce strategy and retain healthy margins

It is well known that ecommerce sales shot up 70% during the beginning of COVID. Grocery online purchases shot up 59%. Prior to this, the prediction was that ecommerce would be up 30% by the year 2030. That was obviously blown out of the water! And while ecommerce began 20 years ago, there was suddenly no choice for those not on board yet, but to learn how to create a social experience online in order to survive and thrive during a worldwide need for contactless transactions.

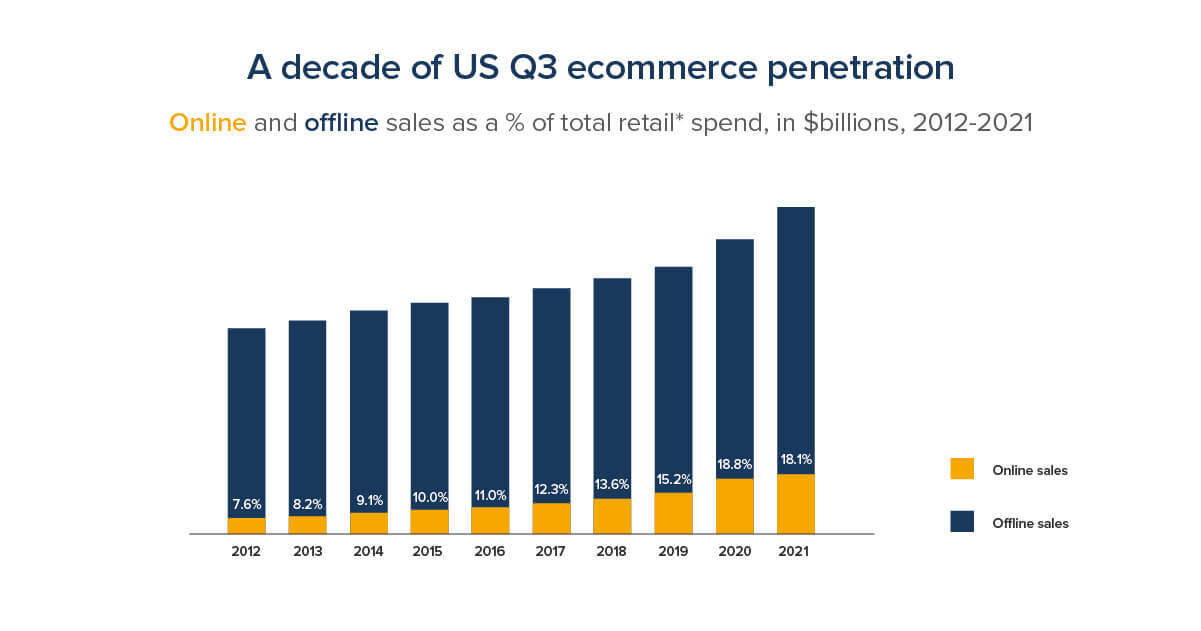

Following a record-breaking surge, ecommerce sales dip slightly but remain strong and well beyond pre-pandemic predictions.

Innovators with a “services first” mindset lead the charge

- Amazon began using old, empty department stores as distribution centers and are now opening brick and mortar stores all the while maintaining that digital assets need to be experiential.

- Walmart put a “services first” model front and center when they offered pet insurance for all the pets purchased during COVID.

- Apple generated nearly $53.8 B in services (Cloud services, Apple Music, Apple TV, advertising, video, payments and insurance) revenue accounting for more than 20% of their total sales in 2020 thereby increasing your reason to purchase Apple and loyalty.

- Restaurants resorted to delivery/curbside pick-up only, reviving or establishing make- shift drive-thrus and walk-ups and the innovators went further with Zoom meet and greets, cooking classes, recipe swaps, meal kits, adding donated meals to your order, virtual wine tastings and more.

Where do you stand as CPG manufacturer and where are things headed? Although ecommerce may be slowing and the return to in-store shopping increasing, ecommerce sales are still up 21.9% in 2021 when compared to the first two quarters of 2020.

5 tips to optimize your CPG ecommerce strategy and survive thinner margins

- Strategy: Consider what services you can provide now and, in the future to enhance the online experience. What’s your pricing and promotional strategy? What’s your everyday price when you sort and where does your product fall? When sorting or searching by promoted price, where does your product position land? Search result optimization is also important and you must consider evaluating the cost of being at the top of the screen.

- People: Review your current organizational structure to determine if you have the right people with the rights skills, working cross functionally to support omnichannel planning.

- Virtual Shelf: Optimize your virtual shelf with the right investments to increase things like search visibility, screen position and digital packaging and by working more closely with your retailers. Your competition is no longer just on the physical shelf. The category has expanded to encompass regional brands, private label and line extensions. This impacts brand equity, which needs to be supported with more promotional activity.

- Omnichannel: Be agile enough to rebalance your omnichannel approach and promotional strategy. We’ve been introduced to BOPIS (Buy Online Pick-up In Store) and now retailers need both an online promotion and brick and mortar strategy, each comes with a cost component. As a manufacturer, do you know where to invest?

- RGM: Continue to embrace ecommerce with consideration given to eRGM or ecommerce revenue growth management as referred to by McKinsey. eRGM is a subset of Revenue Growth Management or the Total Cost of Doing Business. Do you need to make that distinction?

Take a deeper dive with our eBook

Read our first blog Incremental Volume, Promotion Planning, the Shift in CPG to Ecommerce and How to Contain the Fire on CPG ecommerce strategies.

Sources: